Within Nesta, Nesta Challenges uses challenge prizes to stimulate innovative solutions to some of the biggest challenges we face. Challenge prizes are a simple but powerful idea. A problem or opportunity is identified, the challenge is publicised and rewards are offered to those who can deliver the best solutions.

Since the economic crash of 2008, the financial services industry has seen many shake-ups. Arguably, none as impactful to consumers as the introduction of new legislation brought in by the Competition & Markets Authority (CMA) in September 2016. This legislation obligated the banks to open up their Application Programming Interfaces (APIs) which encouraged new challenger brands to enter the market and to offer something new. This introduction was the result of an investigation conducted by CMA into retail banking, which concluded that incumbent, older, larger banks were not doing enough to compete for customers’ business.

The Open Banking Implementation Entity (OBIE) was established by CMA to enforce this mandate and the term ‘Open Banking’ was coined. The goal? To offer greater competition in the financial services market, give consumers more control of their finances and make banking more transparent.

To spread awareness around this shift, Nesta Challenges & OBIE issued a call for the best open banking-powered fintechs to take part in a new challenge — ‘Open Up 2020.’ This wasn’t just about a business objective; there was an opportunity to improve millions of lives by helping customers in the UK build financial resilience and a better relationship with their money.

The challenge, Open Up 2020, needed an effective marketing campaign to get audiences to use these financial solutions.

Marketing a product that people don’t understand

Blue State was tasked with running a digital campaign highlighting 15 separate fintech offerings to demonstrate the value of their solutions and to make them more accessible to a wider range of consumers. Pinpointing a holistic approach across 15 products was a challenge. To many UK citizens, Open Banking was seen as something complicated, boring and unsecure — if they were even aware of it. So, how do you market something that people don’t really understand?

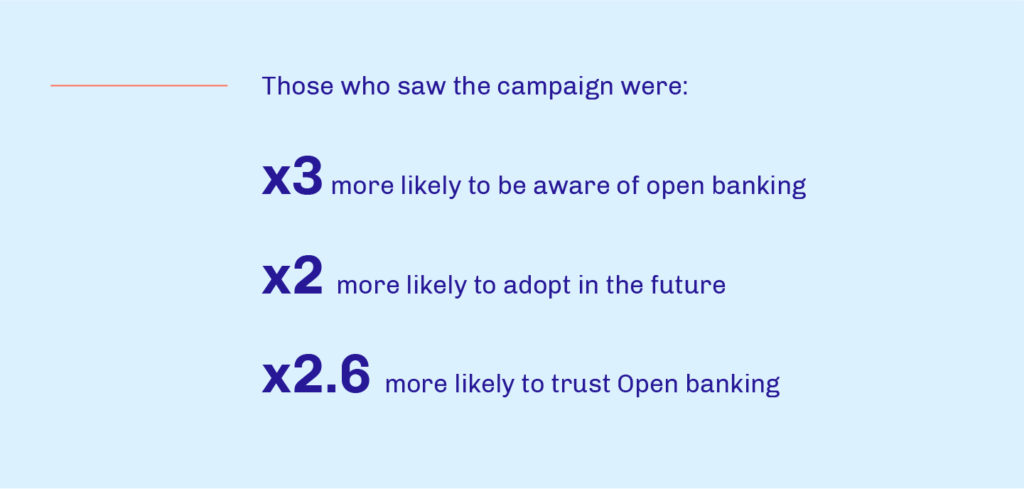

We began by defining and profiling every audience across all of the fintech offerings and mapped out how we wanted to position each individual product to them. We set out to understand what makes consumers aware, interested, and engaged with Open Banking; how we should best communicate this message, who we should be reaching and how to properly relay this information in the middle of a pandemic. With millions of people losing their jobs, or having their finances seriously impacted by the uncertain economic environment, being relevant and useful to consumers was a key priority for this campaign.

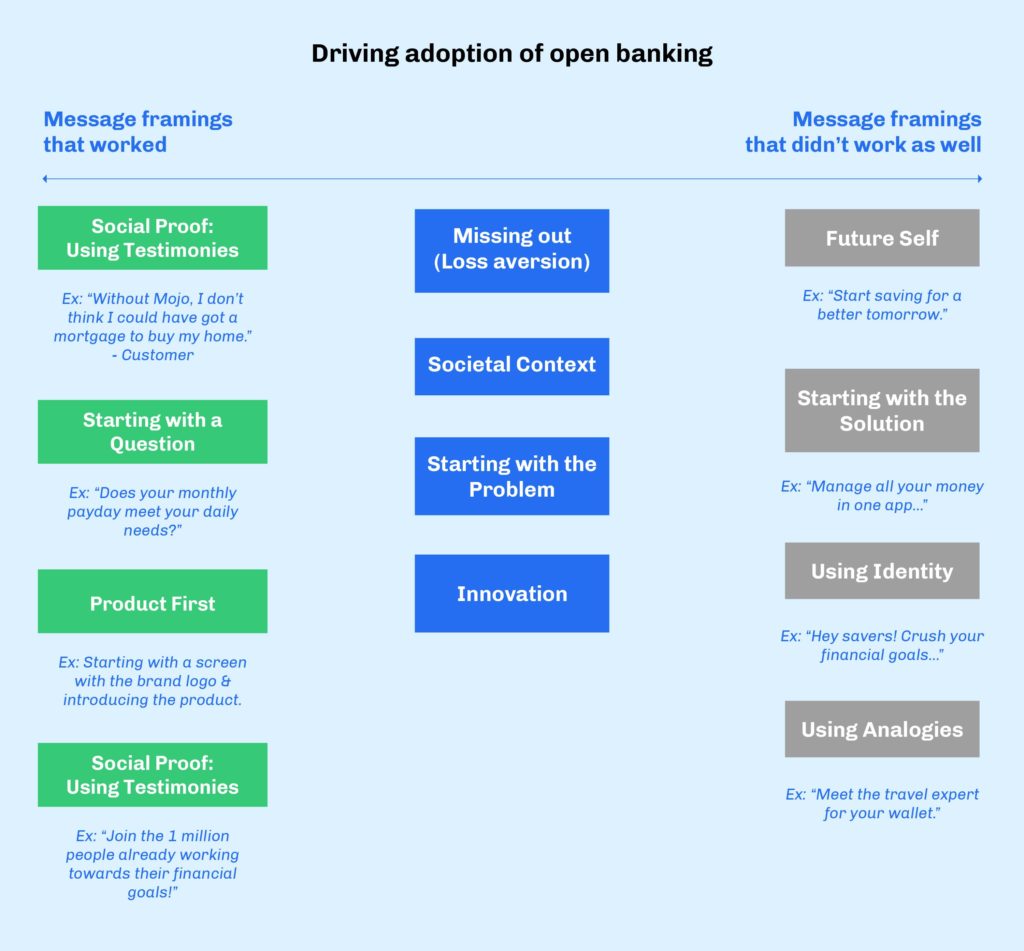

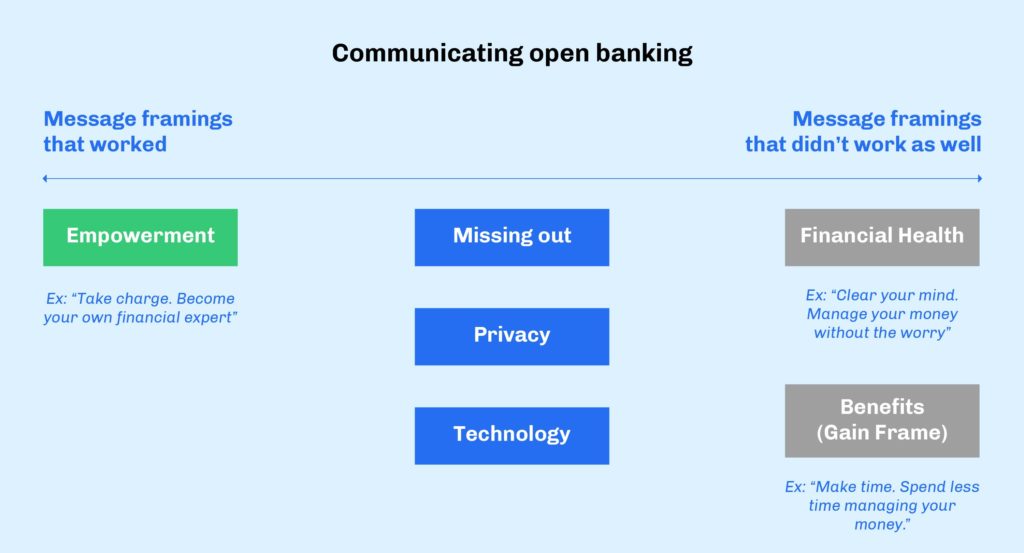

We quickly learned what message framing worked and what didn’t. Customers responded well to messages that made them feel confident and in control of their money. Messages that encouraged audiences to focus on their financial health or “spend less time managing money” did not resonate either.

When trying to build the public’s trust around Open Banking solutions, we found that explaining how Open Banking is governed, regulated and utilized by UK’s largest banks helped allay concerns and increase likelihood of adoption. Clear evidence around the efficacy of these solutions was key.